Business Investment and What It Signals for Business Aviation

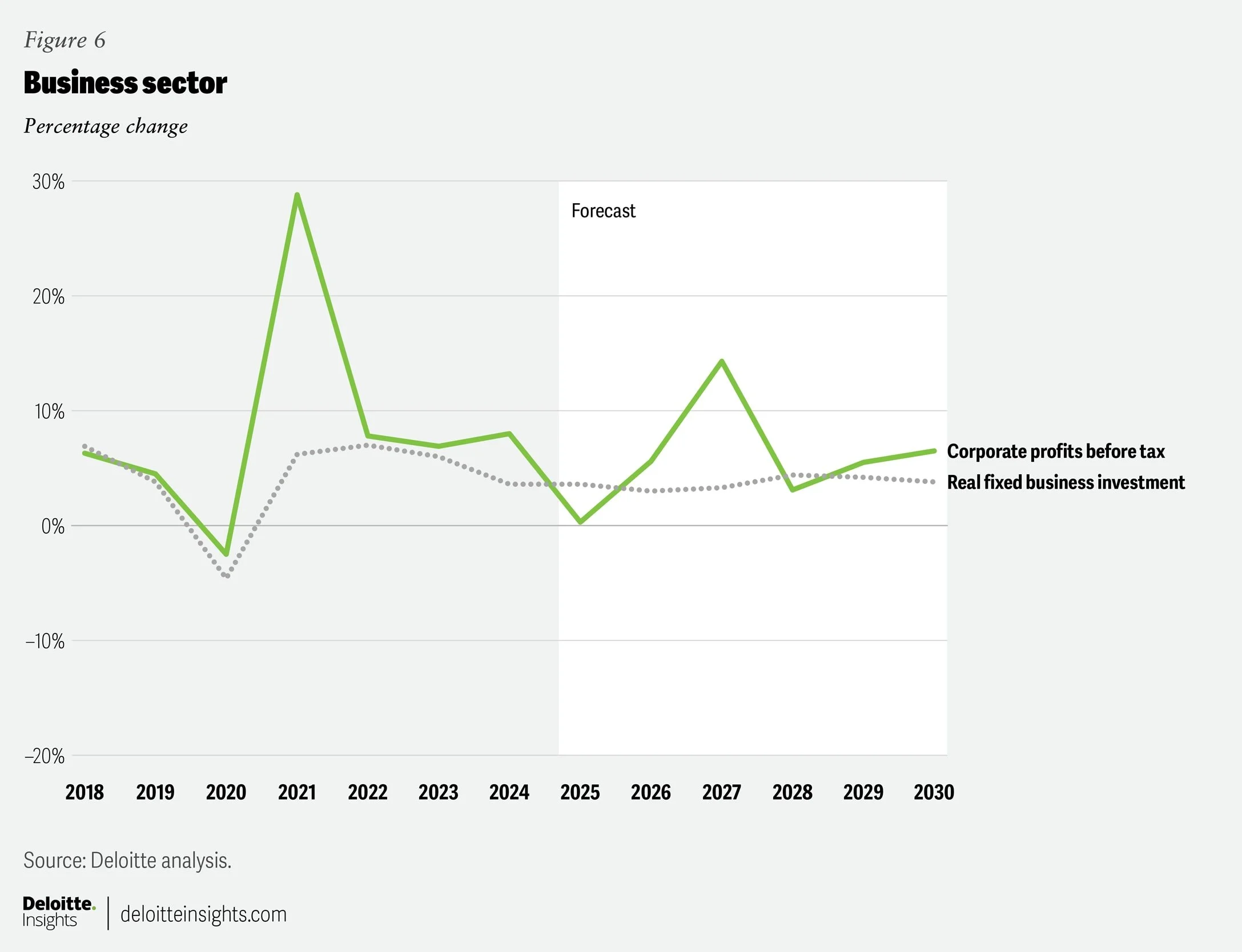

According to Deloitte’s U.S. Economic Forecast for 2025, business investment remains one of the most important indicators of an economy’s long-term productive capacity. Investment typically moves in cycles – rising during commodity or economic expansions and slowing during periods of uncertainty. Policy also plays a role, with incentives such as tax reductions or investment subsidies influencing timing and magnitude.

Business confidence continues to shape these cycles. While sentiment surveys are sending mixed signals, companies have demonstrated resilience by accelerating capital spending in early 2025. Equipment investment surged 24.7 per cent in the first quarter and 7.4 per cent in the second, partly due to tariff anticipation and growing demand for data-center infrastructure amid the AI boom.

Looking ahead, Deloitte forecasts machinery and equipment investment to rise 7.3 per cent in 2025 and 4.0 per cent in 2026, supported by the resumption of bonus depreciation in the U.S. Yet elevated interest rates and tariffs remain headwinds, keeping overall business investment growth at 3.6 per cent in 2025 and 3.0 per cent in 2026.

Figure from Deloitte Insights, “United States Economic Forecast: Q3 2025,” October 2025. Source: Deloitte analysis, deloitte.com/insights.

For business aviation, these patterns matter. Aircraft acquisition often moves in tandem with broader capital-investment trends – rising when companies are confident enough to expand, modernize, or improve efficiency. As firms continue investing in productivity-enhancing assets, aircraft remain part of that strategic equation: tools that extend reach, compress time, and connect growing operations across geographies.

Analysis based on Deloitte Insights’ United States Economic Forecast: Q3 2025. Commentary reflects my own interpretation.